What Your Teen Scores on Their SAT/ACT

It might not be what your teen wants to hear, but a good SAT/ACT score remains a core component of the college admission process.

There’s no direct correlation to future earnings. However, a good test score is a positive indicator of college success [1]. That means the higher your teen’s SAT/ACT score, the more colleges will compete, including elite universities, whose graduates typically achieve higher starting salaries.

Performance standards for your teen’s high school and school district will impact their test score. So too will test preparation, which can improve results by an average of 115 points [2]. The good news is that you don’t need to pay for costly test tuition: the College Board partners with the Khan Academy to provide free online test materials.

Where Your Teen Studies

Studies remain inconclusive, but it appears that there’s a potential earnings payoff for those attending an elite college, a payoff that extends beyond initial earnings [3].

However, there is a caveat, based on socioeconomic factors: More Ivy League students come from wealthy families, whose networks of influence may be better positioned to assure a good career start for their graduating students.

Bear in mind the costs of an elite education, which should be carefully considered, relative to your own finances, as well as any potential benefit to your teen. Scholarships and financial aid packages may help ease the potential financial burden of an Ivy League education.

If you’re concerned about the costs of undergraduate tuition, consider:

- Graduate Studies: If your child plans to pursue a post-graduate degree, the status of that college or university might have more bearing upon future income, possibly reducing pressure to pay for an elite undergraduate education.

- Reducing College Costs: Not all four years of an undergraduate education need to occur at an elite university to achieve their diploma. Many students start at state or community college, or take cheaper supplemental summer classes, to help reduce costs.

What Your Teen Studies

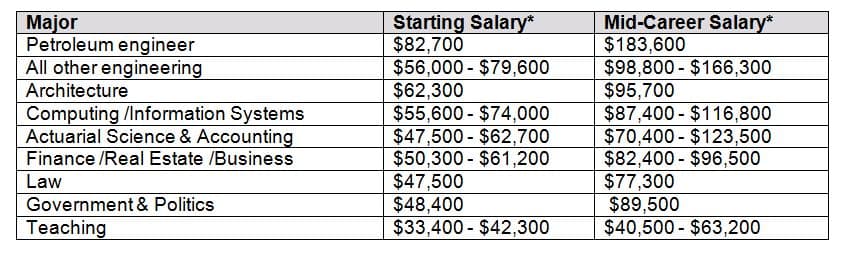

Possibly the single most predictive factor in your student’s potential earnings and future lifestyle is what major they elect.

A professional degree is most lucrative in terms of both starting salary and future career earnings. Conversely, a ‘soft major’ e.g., Psychology or English, means a lower earning bracket – although there is a slight bump if it’s from an elite institution.

Something that often goes unnoticed is that unemployment rates also vary by major.

Despite women’s achievements, the Economic Policy Institute notes that women still receive lower starting compensation than men – even immediately out of college, when study and work experiences are most comparable [4]].

According to Payscale’s 2018 analysis [5], the highest paying bachelor degrees include:

What GPA Your Teen Achieves

Most studies indicate a connection between grade point average (GPA) and starting income [6].

Some employers also use GPAs to limit the applicant pool, so a lower GPA might restrict the type of jobs your teen can apply for.

A GPA isn’t just a quantifiable data point for hiring managers. It also connotes learning ability, tenacity, focus, and other qualities that employers value – and are prepared to pay for. The higher your teen’s starting salary, the more they’ll probably earn across their career, with the highest salary growth occurring during the first decade [7].

What Job Experience Your Teen Accrues

Employers are placing an increased emphasis on experience gained from internships, summer jobs, and part-time employment.

While statistical evidence remains limited as to how on-the-job experience may relate to starting salary, any real-life experience your teen acquires during college will likely make job hunting easier, may increase any initial compensation offer, and at the least, can help supplement their college costs through paid earnings.

Furthermore, the connections your teen makes while working at an internship, temporary, or part-time job, form the basis of their professional network. Networking can help facilitate their job search in the future.

Where Your Teen Decides to Live

The cost of living in different regions of the country varies substantially. This impacts both how much your student can expect to earn upon graduation, and how much it’ll cost to live independently.

The Washington, DC Metro area is one of the most expensive areas in the US [8].

Your teen’s future earning potential shouldn’t be the primary focus of the decisions you make together regarding college choices. However, these broad-reaching implications on your student’s future finances and lifestyle mean that earning potential should certainly factor into your shared discussions. Start the conversation about realistic career and life expectations early, preferably as your teen enters high school.

SageVest Wealth Management, the parent company of SageVest Kids, can help you plan financially for college funding, and guide you, your student, and your family towards wealth success. Please contact us to find out more.

Additional College Planning And Education Resources

College Scorecard – the US Department of Education’s college comparison site.

www.educatetocareer.org – provides educational, career, and earnings data for students, colleges, and employers.

Sources

[2] https://www.collegeboard.org/releases/2017/average-score-gains-on-redesigned-sat

[3] https://www.payscale.com/college-salary-report/bachelors

[4] https://www.epi.org/publication/the-class-of-2017/

[5] https://www.payscale.com/college-salary-report/majors-that-pay-you-back/bachelors

[6] https://www-test.iwu.edu/economics/PPE17/oehrlein.pdf

[7] https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr710.pdf

[8] http://www.businessinsider.com/how-much-you-need-salary-afford-home-2017-8